Electricity Markets 101: Switching On Clarity About Power Prices

The what, when and how of U.S. electricity markets

Have you ever seen your electricity bill and wondered how this seemingly arbitrary price came together? What does it mean to have 10,791 kilowatt-hours (kWh) of consumption in a year? Who determines how much I am paying per kWh used? And what the heck is a kWh anyways?

Today’s piece covers the basics of electricity markets, who the participants are, how electricity prices are determined, and the differences between regulated and deregulated electricity markets.

Let’s shed some light 💡 into the dark today.

We all experienced it last year: when fuel prices rise, electricity bills rise too. To be able to understand how electricity is priced, we first need to understand how it is measured.

How to Measure Electricity Consumption: The Watt Counting Meter

In the industry, electricity is measured in the unit of Watts (W). A Watt is a single unit of power. It represents the rate at which electricity is produced, transmitted or consumed. Looking at this over time, we get Watts per hour. Consumption is measured via the electricity meter.

If you turn on a reading lamp with a 60W lightbulb for one hour, you are using 60 Watts per hour. Sum up the demand of all your appliances and devices at home and you will end up on the scale of kilowatt-hours (1000 Watts = 1 kilowatt) per year.

The amount then gets multiplied with the price per kWh the energy provider charges. Et voilá, you have your utility bill.

The average American household purchased 10,791 kWh from utilities in 2022. The average retail price was $0.12 per kWh (varies heavily between states). That gives us an average bill of ~$1,295 per year.

So far so good.

Now, let’s look at how we can slice and dice electricity markets into smaller chunks.

Electricity Markets: Untangling the Mystery

As

describes in his great piece on electricity markets, there are 11 of them. I will keep this higher level, but encourage you to check out his post too.In the U.S., it varies between regions and states how you purchase your power. Generally speaking, there are two broad types of electricity markets:

Regulated markets (~33% of U.S. electricity market)

Deregulated markets (~67% of U.S. electricity market)

So, what is the difference?

Regulated vs. Deregulated Markets

Up until the early 1990s, regulated markets were the norm. In this case, the utility company owns all three steps of the grid operations. Electricity generation, transmission and distribution, and sale to the end consumer. Customers have no choice and need to purchase their power from the local utility company.

The so-called “vertically integrated monopoly” is regulated by the public utility commission (PUC), which oversees how the electricity price is set. The price is a combination of several factors:

Operational costs - burning the fuel to produce power

Investments costs - building the power plant

Fair margin of profits - granting operators a “fair” margin of profits

This prevents the utilities from taking advantage of their monopolistic position.

In this setup, the customers bear the investment risk taken on by the utility company. Since the investment cost is part of the price the utility charges, there could be a scenario where customers pay for a power plant that was built but never ends up producing any power.

Eventually, some people started challenging this setup.

Deregulated markets have been around since the beginning of the 1990s, when many U.S. states decided to abandon the regulated market structure. Their intention was to create lower electricity costs through competition.

As a result, more players entered the energy playing field. The utilities still held on to the transmission infrastructure while the generation and retail parts were opened up.

Out of this, today’s wholesale and retail electricity markets were born.

Retail Electricity Markets: Where You Are Buying Your Power

In areas with deregulated markets, customers can choose an electricity supplier (so-called “customer-choice”). Following supply and demand principles, suppliers offer competitive prices to acquire customers. Usually, customers sign contracts with fixed $/KWh prices for a certain period.

The choice only impacts the electricity generation part of your bill since transmission and distribution are still utility-owned and regulated.

On the upside, customers benefit from lower electricity prices and more flexibility to choose how the electricity was generated (e.g. signing a contract that exclusively uses green electricity).

On the downside, customers sign contracts with set prices per kWh for a certain period of time. This locks them into a dollar/ kWh price that is potentially higher than the current retail price.

But how does the company selling the power get it in the first place?

Wholesale Electricity Markets: Where Your Power Dealer Buys Their Power

Retailers and utilities in deregulated areas usually do not produce their own power. They purchase the power on wholesale electricity markets and then sell it to consumers.

Who operates these markets?

Currently there are ten transmission areas within the U.S.

Northwest, Southwest and Southeast are regulated markets. The remaining seven are deregulated markets.

Those seven can be categorized as either a Regional Transmission Organization (RTO) or an Independent System Operator (ISO). Both are the governing bodies who run the wholesale markets.

They have to comply with certain criteria, such as being run as a non-profit, providing non-discriminatory access to the transmission grid, and being disallowed from owning grid equipment.

Regulators initially introduced ISOs in 1996 and shortly thereafter encouraged the formation of RTOs serving larger geographical areas. By now, the two terms have become almost interchangeable.

Whenever someone drops them in a conversation, they are essentially talking about the same thing: Transmission.

Glad we’re done with the who. Let’s look even one level deeper at the functions electricity markets inherit.

Hold My Electron, Markets Within Markets?

Before we get to the how, we need to understand the nuances of electricity markets. There is not one electricity market where buyers and sellers come to an agreement and trade the commodity. It is a bit more complex than that.

Broadly speaking, each RTO runs three different types of power markets:

Energy markets

Capacity markets

Ancillary markets

Energy markets consist of the day-ahead and the real-time markets.

The day-ahead market makes up 95% of all electricity traded. Real-time markets adjust real-time fluctuations to ensure grid balance and make up the remaining 5%. Power is traded on a day-by-day basis.

Capacity markets ensure grid reliability. Retailers are required to plan enough electricity generation for the next day plus a reserve margin in case of unplanned fluctuations. They pay generators to reserve capacity in case it is needed.

Ancillary markets help regulate grid frequency and provide short-term backup power in case of electricity generation failures.

Ok cool Basti, but can we know get to the part where you draw simple visualizations and tell us how wholesale electricity prices are determined?

Powering Fantasy City: An Example

Let’s use a simple example to illustrate the process.

In Fantasy City, we need to plan the electricity demand for tomorrow. We use historical and weather data as well as any additional information we can get that might influence tomorrow’s electricity demand. We plan in megawatts/hour (MWh).

Once we forecasted the demand for tomorrow, we have a demand curve by hour of the day:

Now that we kind of know the demand at every hour of the day, we turn to the generators. We have one nuclear plant, one coal plant, one gas turbine, and one wind farm available.

Each of these plants is capable of offering a certain price for one unit of electricity they can supply. Since generation happens in the scale of MW, the following prices are bid:

Wind = 1$/MWh

Nuclear = 2$/MWh

Coal = 3$/MWh

Gas = 4$/MWh

Based on these, each power plant bids into the market. Additionally, each plant has a maximum capacity they can supply. Adding those max. capacities in ascending price order gives us the following generation stack.

Energy markets follow the logic of dispatching the cheapest source first to minimize the electricity price (so-called “merit-order”).

Let’s say we want to plan the power demand for 10am. We know that we have a demand of 21 MWh. Following the merit-order, we would dispatch as follows:

We would get 10 MWh from the wind farm for $10 and 11 MWh from the nuclear plant for $22. Total electricity cost = $32 for 21MWh. Great!

If only it would be that simple.

In electricity markets, every electricity generator receives the clearing price. Whenever supply meets demand, the market “cleared”. The last source dispatched is the price-setter for everyone else.

Since the market cleared at $2/MWh, the nuclear plant sets the price for all other providers as well. Therefore, the wind farm also receives $2/MWh supplied. Even greater for the wind farm.

So in total we have $42 in costs for 21 MWh purchased, composed of

Wind = 10MWh * $2 = $20

Nuclear = 11MWh * $2 = $22

This is how wholesale electricity prices are determined. The actual dispatch of resources is impacted by several real-world constraints.

Some plants, like nuclear, must run for a long period of time (100+ hours) since they cannot be easily ramped up and down. They are often used to serve the base load in combination with long-term Power Purchase Agreements (PPA).

For instance, let’s say Fantasy City’s electricity demand forecasters know that electricity demand will never go below 10 MWh. They turn to the nuclear plant to purchase 10MWh base load for the next 12 months. In return, they can expect a lower price for electricity.

On the other side, the wind and the sun cannot be turned on and off at will, making them less reliable and less controllable energy sources. Thus they are not ideal sources to serve the base load.

You see, there is a complicated system behind electricity markets. But generally speaking, the exemplary process shown above determines daily electricity prices.

Now that we know how wholesale prices are determined, let’s check out what else affects the price we see on our utility bills.

The Pieces Coming Together: Components of the Final Electricity Price

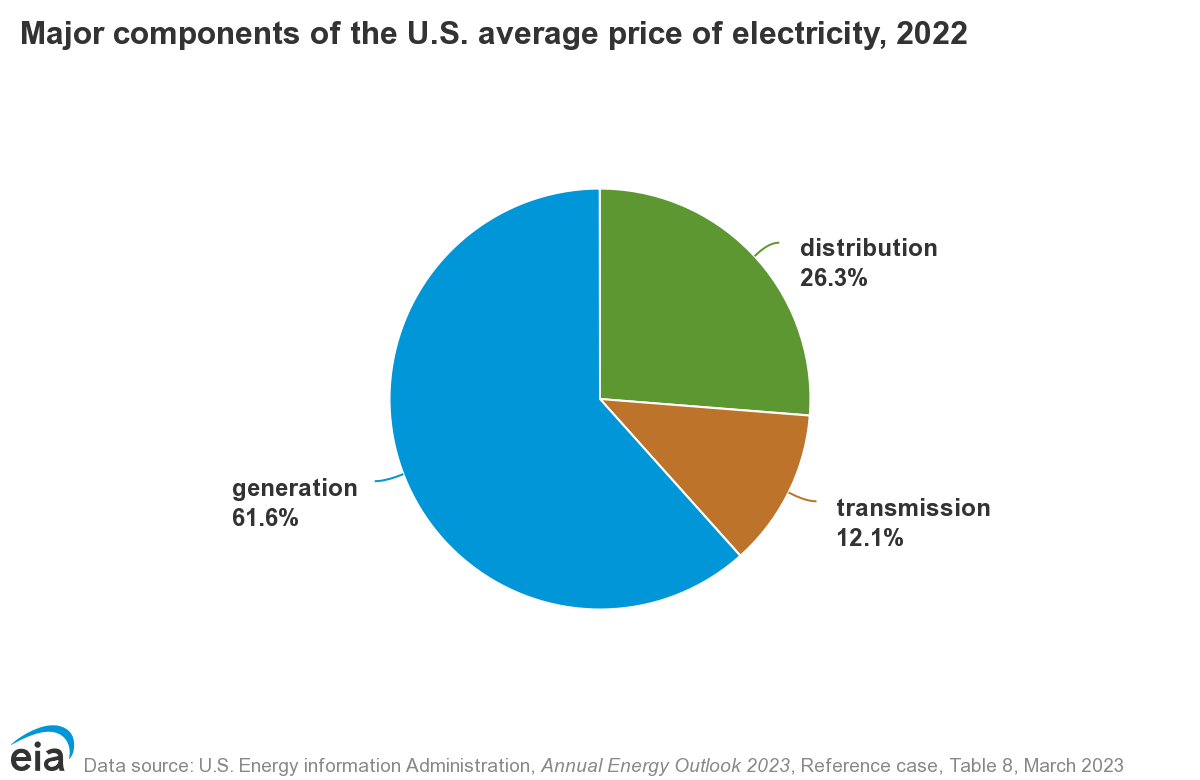

The final price is composed of 3 components:

Electricity generation → fuel cost, fixed and variable operational and management costs, and capital cost

Transmission and distribution fees → costs of RTO to operate and maintain transmission lines and infrastructure

Tax and additional fees → VAT, environmental fees, etc. (varies by state, but usually make up less than 10% of the electricity price)

Electricity prices vary by customer. Industrial customers can handle higher voltages, so they need less infrastructure between the power plant and industrial consumer site, which reduces the costs. They also consume a lot more power than residential customers, hence strengthening their negotiation position when signing a PPA.

As show in the example from Fantasy City, electricity prices rise as demand rises. During peak demand, all base load resources are running at full capacity, requiring more expensive power plants to generate the needed electricity to satisfy peak electricity demand.

That’s why electricity is more expensive in summer months - because demand is generally higher.

All these factors are considered by retail energy suppliers when calculating the rates you are eventually charged.

Who is Watching All the Chaos Ensuring Compliancy?

There are several regulating entities ensuring functioning electricity markets. Their job is to ensure fair price-setting mechanisms and safe operations.

There are three different layers:

On a national level, the Federal Energy Regulatory Commission (FERC) oversees the commerce of transmission and wholesale electricity markets.

On a state level, the Public Utility Commission (PUC) regulates the services and rates of utilities as shown above in regulated markets.

On a local level, the local city or county government regulates the electricity commerce among waste water management and telecommunications.

Regulation and oversight is crucial in a market that trades such an important commodity to avoid an unregulated monopoly.

Whew, that was a tough one.

All the basics are covered. Now you should have a much better understanding around electricity markets operate, thanks to Fantasy City!

If you cannot think of anything more exciting than getting the raw information on electricity markets, I encourage you to read the 150-page energy primer from FERC.

Otherwise, take a break and do something fun. You deserve it after this one.

Like analyze your electricity bill with your newly gained knowledge. Or tell your neighbor about it. Oh and while you’re at it, tell them to subscribe to CC. Did you do it?

If you feel as though I didn’t do a good job describing electricity markets in broad strokes, then please leave a comment. If you think I did a great job, please leave two.

That’s it for this week. Tune in again next time for equally fun content!

Stay electric,

Basti

If I upload a picture of an electrical bill, can you review it? Asking for a friend.

Great overview, informative and fun!